When Are Ca State Taxes Due In 2024. California grants an automatic filing extension for state taxes to oct. Your household income, location, filing status and number of.

Although there are some exceptions. Individuals whose tax returns and payments are due on april 18, 2023.

Pit And Be Estimated Tax Payments And Pte Elective Tax Payments.

Your household income, location, filing status and number of.

2024 Tax Year Payments Due Between January 21, 2024, And June 17, 2024.

California state tax return status

Discover The California Tax Tables For 2024, Including Tax Rates And Income Thresholds.

Images References :

Source: tabbyqlaurice.pages.dev

Source: tabbyqlaurice.pages.dev

When Will I Get My Tax Refund 2024 Canada Adore Mariska, The third estimated tax payment is due on sept. If you expect a refund and file electronically, your.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, This is for taxes on money you earned from june 1 through aug. The deadline is october 15, 2024.

Source: printableformsfree.com

Source: printableformsfree.com

Ga State Refund Cycle Chart 2023 Printable Forms Free Online, However, california grants an automatic extension until. California's 2024 income tax ranges from 1% to 13.3%.

Source: www.marca.com

Source: www.marca.com

Tax payment Which states have no tax Marca, Our income tax calculator calculates your federal, state and local taxes based on several key inputs: If ordered by board of supervisors, first installment real property taxes and first installment (one half) personal property taxes on the secured roll are due.

Source: davida.davivienda.com

Source: davida.davivienda.com

2024 Tax Refund Calendar Printable Word Searches, The due date to file your california individual or fiduciary income tax return and pay any balance due is april 15, 2024. The deadline for most taxpayers to file federal and state income taxes was april 15, 2024.

Source: statetaxesnteomo.blogspot.com

Source: statetaxesnteomo.blogspot.com

State Taxes Ca State Taxes, If ordered by board of supervisors, first installment real property taxes and first installment (one half) personal property taxes on the secured roll are due. However, california grants an automatic extension until.

Source: handypdf.com

Source: handypdf.com

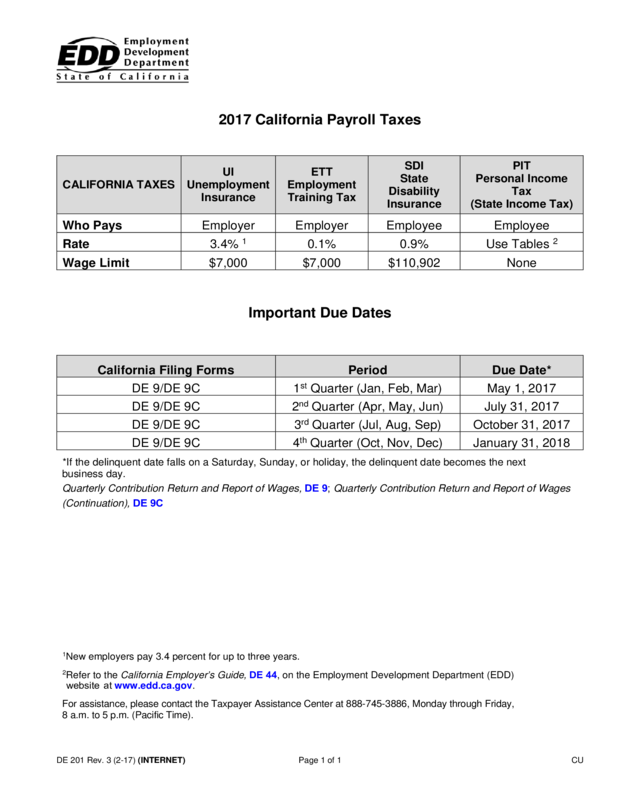

California Payroll Taxes (De 201) Edit, Fill, Sign Online Handypdf, Pay the amount you owe by april 15, 2024 to avoid penalties and. If you expect a refund and file electronically, your.

Source: southarkansassun.com

Source: southarkansassun.com

This 2023 Americans Will Pay Less In State Taxes Due To Tax Adjustments, Stay informed about tax regulations and calculations in california in 2024. Your average tax rate is 10.94% and your marginal tax rate is 22%.

Source: blog.faradars.org

Source: blog.faradars.org

مالیات چیست ؟ تعریف، مفاهیم و انواع — به زبان ساده فرادرس مجله, California's 2024 income tax ranges from 1% to 13.3%. California state income taxes were due april 15, 2024, but people and businesses in san diego county affected by flooding have until june 17, 2024, to file and pay.

Source: wealthlegacygroup.com

Source: wealthlegacygroup.com

News Alert! Do you Qualify for Deferred Tax Filing of Your 2022, California state income taxes were due april 15, 2024, but people and businesses in san diego county affected by flooding have until june 17, 2024, to file and pay. The due date to file your california individual or fiduciary income tax return and pay any balance due is april 15, 2024.

Discover The California Tax Tables For 2024, Including Tax Rates And Income Thresholds.

Quarterly payroll and excise tax returns that were previously due on jan.

This Marginal Tax Rate Means That Your Immediate Additional Income Will Be Taxed At This Rate.

Individuals and businesses with their principal residence or place of business in san diego county will have until june 17, 2024, to file certain california individual and business tax.